The seller wants the most for their home and the buyer wants to pay the least possible. From the very beginning of the home buying process, there are adversarial positions between the principals. If you happen to be in a multi-offer situation, it just complicates things further.

Then, there are the emotions that tend to cloud the decision making on both sides of the transaction. Sellers have lived in the home for years, possibly, with cherished family experiences and maybe, having put considerable effort and money into capital improvements.

On the buyer side, they may have lost out on several homes due to competing offers and now, this year, interest rates have doubled, and the discretionary funds required to pay for a home could be causing cuts in their budget in other areas.

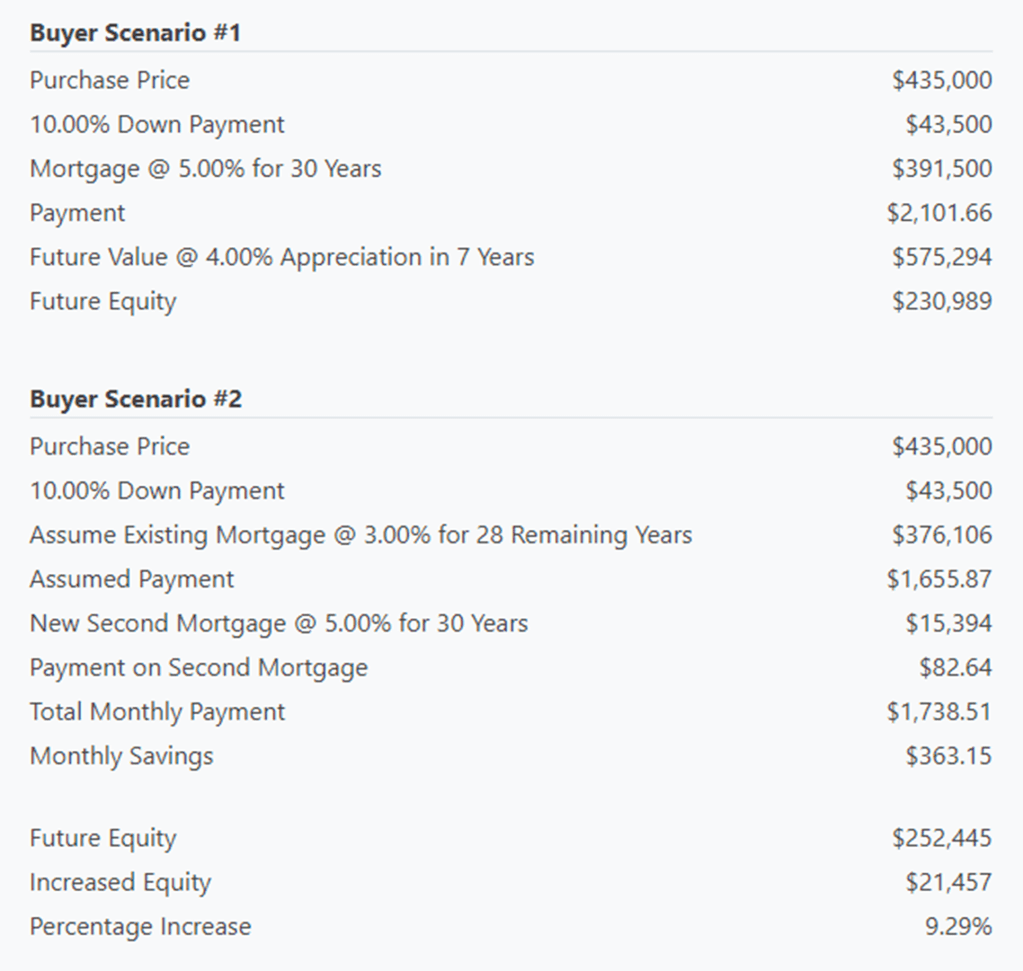

A year ago, buyers were waiving contingencies for financing, appraisals, inspections, and other things just to be competitive. Today, to make the home more affordable with the higher mortgage rates, buyers need the seller to make financial concessions but who is going to make their case to the seller for them?

The role of a third-party negotiator played by the real estate professionals has always been valuable to the success of the transaction but now, it may even be essential. Sellers enjoyed an extraordinary market in their favor for the past two years with incredible appreciation and so many buyers chasing so few homes, the sellers were able to write their own ticket.

Inflation and mortgage rates have put the brakes on the market, eliminating over 15 million mortgage-ready buyers. The buyers who are still in the market need to be cautious, so they don’t overextend themselves and overpay for a home.

The agents can assist both the buyers and sellers in seeing things in an objective way that reflects the current market and not the way it was a year ago. All parties must be reasonable and not expect too much. They need to consider facts and not feelings.

Negotiating the sale or purchase of a home is a competition; for one person to get something, someone must give something up. If a person doesn’t feel comfortable with this, it is important to work with an agent who can bring their skills to the table on your behalf. As your advocate, they can champion your position and put transactions together that would not have been possible if it were left to the principals alone.

Negotiation skills are acquired through training and experience. When interviewing an agent, ask them what role negotiation plays in their marketing plan if you’re a seller and purchase plan, if you are a buyer. An agent who cannot defend their position in the transaction may not be the right person to defend yours.

Gary Thompson

CRS, SRS, SFR, e-Pro, Broker Associate

Masters Utah Real Estate

(801) 821-9292

5486604-AB00

Contact Me Visit Website Subscribe to Newsletter